Transaction Advisory Services Fundamentals Explained

Wiki Article

The 9-Second Trick For Transaction Advisory Services

Table of ContentsThe Transaction Advisory Services DiariesLittle Known Questions About Transaction Advisory Services.6 Easy Facts About Transaction Advisory Services DescribedGetting The Transaction Advisory Services To WorkWhat Does Transaction Advisory Services Mean?

This action makes certain business looks its ideal to prospective buyers. Obtaining business's worth right is important for an effective sale. Advisors make use of different techniques, like discounted money flow (DCF) analysis, comparing with comparable business, and current purchases, to figure out the reasonable market value. This aids set a fair cost and discuss efficiently with future purchasers.Deal consultants action in to aid by getting all the needed info organized, addressing concerns from purchasers, and setting up check outs to business's location. This constructs depend on with customers and maintains the sale relocating along. Obtaining the very best terms is essential. Purchase advisors use their knowledge to aid business owners take care of tough arrangements, meet purchaser expectations, and structure deals that match the proprietor's objectives.

Meeting lawful regulations is crucial in any organization sale. Transaction advising services deal with lawful professionals to create and assess agreements, agreements, and various other legal documents. This lowers threats and makes certain the sale follows the legislation. The function of purchase experts expands beyond the sale. They assist company owner in preparing for their following actions, whether it's retired life, starting a new venture, or managing their newfound wealth.

Purchase advisors bring a wide range of experience and expertise, ensuring that every facet of the sale is handled properly. With strategic prep work, appraisal, and arrangement, TAS aids organization proprietors accomplish the highest possible list price. By making sure lawful and governing compliance and managing due diligence alongside other bargain team members, purchase experts lessen potential dangers and liabilities.

Some Known Questions About Transaction Advisory Services.

By comparison, Big 4 TS teams: Job on (e.g., when a possible purchaser is conducting due persistance, or when a bargain is shutting and the purchaser requires to incorporate the business and re-value the seller's Equilibrium Sheet). Are with costs that are not connected to the offer shutting efficiently. Make costs per engagement someplace in the, which is much less than what financial investment financial institutions gain also on "tiny deals" (however the collection probability is likewise much greater).

The meeting inquiries are extremely similar to investment banking interview questions, however they'll focus more on accountancy and appraisal and less on topics like LBO modeling. For instance, expect concerns regarding what the Change in Working Funding ways, EBIT vs. EBITDA vs. Earnings, and "accounting professional just" subjects like trial balances and how to go through occasions making use of debits and credit histories instead of monetary declaration changes.

Indicators on Transaction Advisory Services You Should Know

that demonstrate how both metrics have changed based on products, channels, and consumers. to evaluate the precision of monitoring's previous forecasts., including aging, stock by item, average levels, and provisions. to figure out whether they're totally fictional or somewhat credible. Professionals in the TS/ FDD groups may likewise interview monitoring concerning whatever over, and they'll write a detailed record with their findings at the end of the process., and the basic shape looks like this: The entry-level function, where you do a whole lot of information and monetary analysis (2 years for a promotion from below). The next level up; comparable work, yet you obtain the even more fascinating bits (3 years for a promo).

Specifically, it's challenging to get advertised past the Manager level since couple of people leave the work at that phase, and you need to begin showing evidence of your capacity to generate revenue to advance. Let's start with the hours and way of life because those are less complicated to explain:. There are occasional late evenings and weekend job, but nothing like the frenzied nature of financial investment financial.

There are cost-of-living changes, so anticipate lower compensation if you're in a less costly place outside significant financial (Transaction Advisory Services). For all positions except Partner, the base pay makes up the mass of the complete settlement; the year-end bonus could be a max of 30% of your base income. Typically, the ideal means to description raise your revenues is to change to a various company and discuss for a greater salary and reward

Rumored Buzz on Transaction Advisory Services

You could obtain right into corporate development, yet financial investment banking obtains harder at this stage due to the fact that you'll be over-qualified for Expert roles. Business finance is still an option. At this phase, you should simply remain and make a run for a Partner-level function. If you intend to leave, maybe relocate to a client and perform their evaluations and due persistance in-house.The main problem is that due to the fact that: You usually need to join an additional Huge 4 team, such as audit, and job there for a couple of years and after that relocate into TS, work there for a couple of years and then relocate right into IB. And there's still no warranty of try this web-site winning this IB role because it depends on your region, customers, and the employing market at the time.

Longer-term, there is likewise some threat of and due to the fact that evaluating a business's historical financial details is not specifically rocket science. Yes, human beings will constantly require to be involved, yet with even more sophisticated technology, reduced headcounts could possibly sustain client involvements. That claimed, the Purchase Providers team defeats audit in terms of pay, job, and leave chances.

If you liked this post, you could be thinking about reading.

Some Known Questions About Transaction Advisory Services.

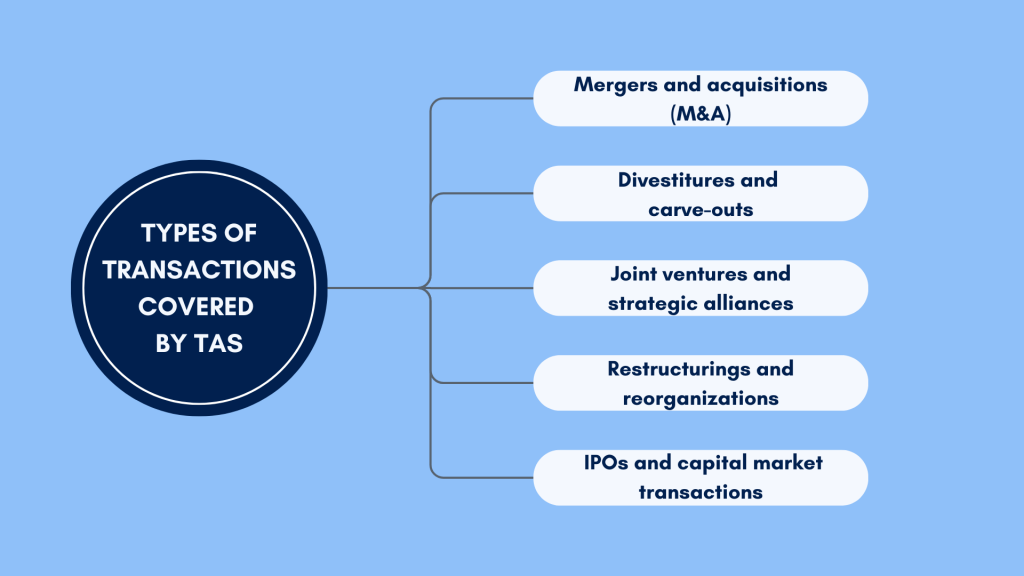

Establish advanced monetary structures that aid in figuring out the actual market worth of a company. Give advisory operate in relation to service assessment to assist in bargaining and prices structures. Explain the most appropriate form of the offer and the sort of factor to consider to employ (cash, supply, make out, and others).

Establish activity prepare for threat and direct exposure that have actually been recognized. Do integration preparation to figure out the process, system, and business adjustments that may be required after the offer. Make mathematical quotes of integration costs and advantages to examine the economic reasoning of integration. Set guidelines for integrating divisions, modern technologies, and service processes.

Determine possible decreases by minimizing DPO, More Info DIO, and DSO. Examine the prospective client base, market verticals, and sales cycle. Take into consideration the possibilities for both cross-selling and up-selling (Transaction Advisory Services). The functional due persistance provides important understandings right into the performance of the firm to be gotten concerning threat assessment and worth development. Recognize short-term adjustments to financial resources, financial institutions, and systems.

Report this wiki page